Module 2 is an introduction to the framework and system that you’ll be learning and putting into practice to begin your journey of purposeful, exponential wealth building.

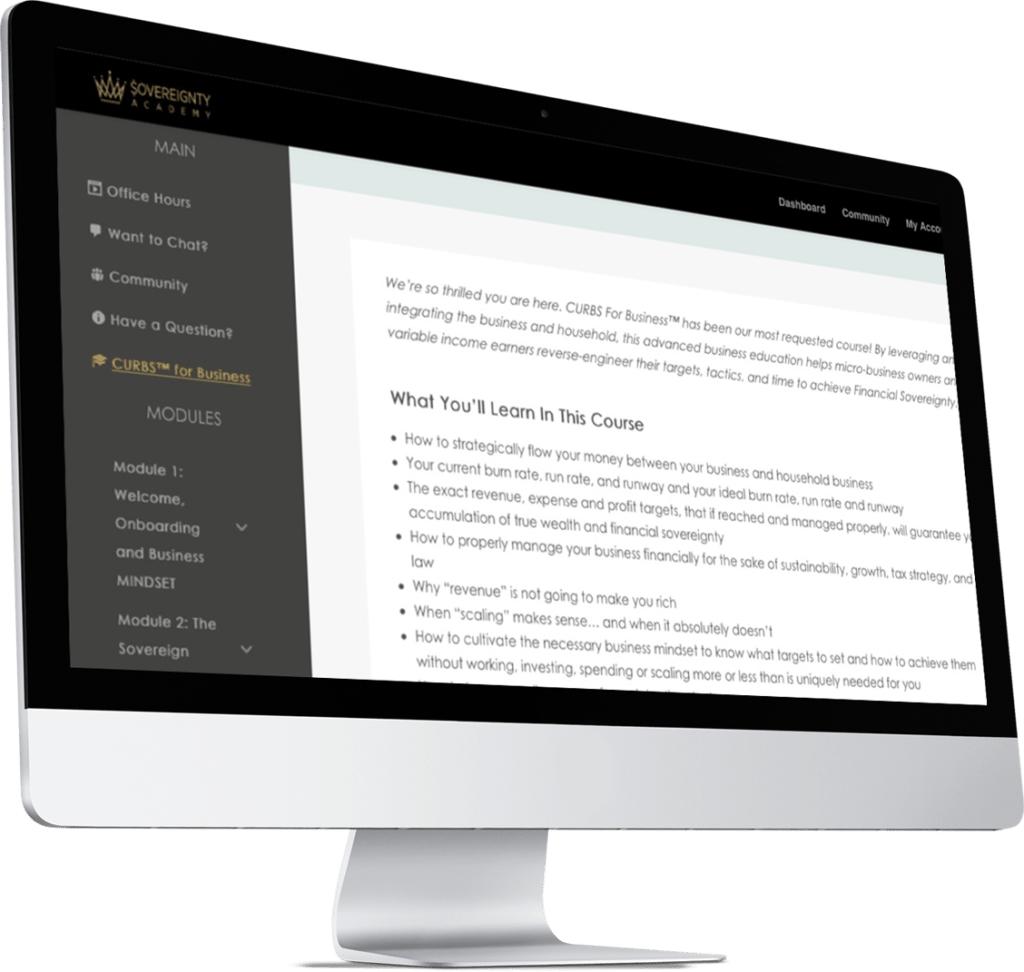

What’s covered in the CURBS™ Introduction:

- A strong overview of the exponential wealth building framework

- A comparison and explanation of the old model of wealth accumulation vs. the CURBS model. Explaining why the old model takes most people 40 years and 40+ hour work weeks to “accumulate wealth,” when it doesn’t have to.

- The distinction between passive and working income and a declaration of what your goal should be in terms of both.

- Determination of how much your spending habits are costing you quantifiably.

- A simple technique to implement every time you spend, in which can save you at a minimum a few more dollars, but at a maximum contribute to the reaching of your financial freedom.

- Understanding the comparison between a business and a household business.

Categorize focuses on a particular piece of the CURBS practice: Categorizing your expenses. You’ll work with this through an exercise encompassing a full personal profit and loss statement and will discover how much of your income you’re spending in 8 different categories.

What’s covered in Categorize:

- A thorough explanation of the money categorization process, and why it is/will be crucial to your money mastery success.

- A deep, detailed exercise consisting of completing a full personal profit and loss statement and categorizing every single facet of cash outflow and cash inflow.

- A discovery of what percentage of your income you’re spending in 8 different master categories

- A deep dive into your financial statements with a microscopic view of a typical month looks like for you financially.

Time: 2-3 hours