Welcome back to Week 4 of my Wise Money Blog series!

As you know, I am an author, speaker, and business owner.

I teach lifestyle entrepreneurs how to achieve financial freedom through my signature money course, Wise Money CURBS.

CURBS is a fundamental financial framework that I’ve developed over the years, and it forms the backbone of the wealth-building techniques I have used to earn millions of dollars.

In this Blog series, I’m sharing some of the key takeaways from the live portion of the program called “Office Hours,” where I dive deeper into the work the students have done on their own.

This blog explains the R in CURBS. (Click here to read the first 3 blogs in the series.)

Now, let’s get to it!

The R in CURBS is what I refer to as the Millionaire Formula.

This formula is a ratio that I teach my students to use to determine how much they can spend in each of my 5 spending categories.

At this point in the course, many of my students “uncover” that they are overspending in some areas and underspending in others, leaving them with no profit.

Without profit, they have no money left for financial security or the creation of financial freedom.

Like solving a Rubik’s Cube, building wealth requires following a step-by-step method. Without directions, both are nearly impossible.

At this point in the course, I teach my students my algorithm for building wealth.

They’re on their own for Rubik’s Cube!

Over the years, I have developed the 20-80-20 Ratio as the ideal formula for building wealth.

The 20-80-20 is the guidance system for spending every dollar of your hard-earned money in a way that basically guarantees the creation of a million dollars of net worth.

So, if you’re tired of feeling like you’re running on a hamster wheel with little financial progress to show for it, the 20-80-20 might just be the solution you need to create true financial freedom.

It’s as simple as this…

The Millionaire Formula

20% of “Income Money” is earmarked as “Investing Money” (Profit First)

80% of what’s left over is earmarked as “Lifestyle Money”

20% of what’s left over is earmarked as “Savings Money”

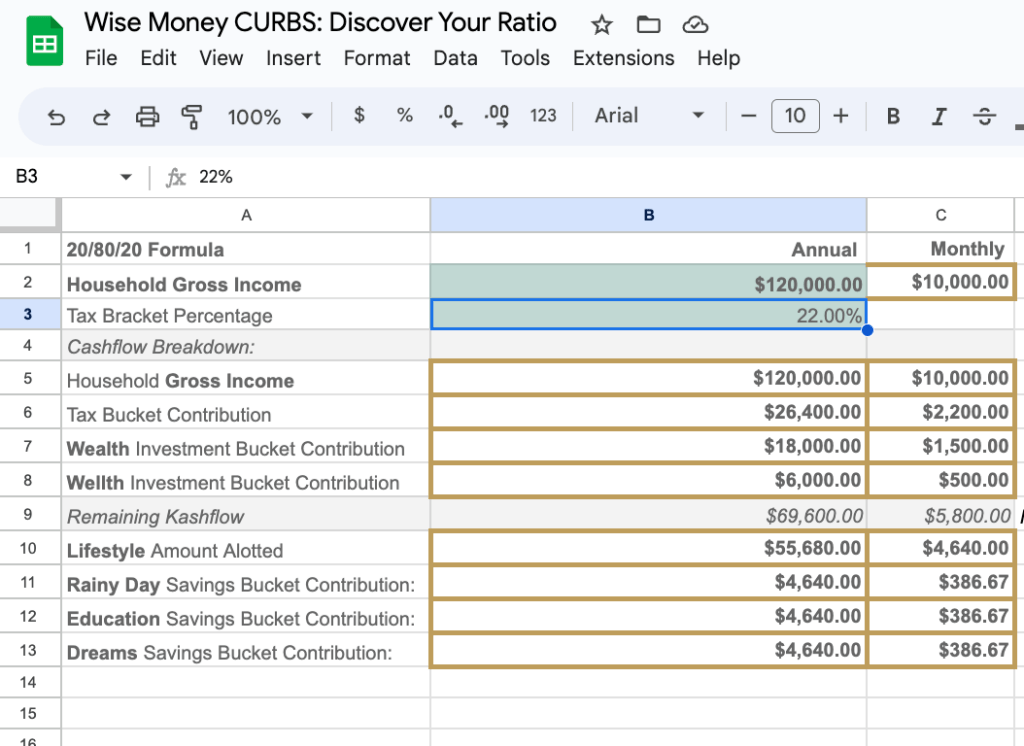

In the example below (using the Wise Money Kashflow Calculator) you can see how you would divide up your money if you made $120,000.

- Income $120,000/$10,000 per month

- Investing Money: 20% of income: $2,000 per month (divided by Wealth & Health investments)

- LifeStyle Money: 80% of what’s left over ($5800) after taxes: $4,640 per month

- Savings Money: 20% of what’s left over ($5800) after taxes: $1160 per month (divided into 3 savings buckets)

With the Wise Money Kashflow Calculator, students easily track their spending, showing them why they’ve been stuck on the financial hamster wheel.

It’s likely that most of your $10,000 income is being spent on line 10 – Lifestyle Expenses.

This is where the real work starts! You realize that if you want to build wealth, you’ll have to change your spending patterns.

You’ll have to start making the “trade-offs” that I talked about in the last blog post.

Just this week, a student in one of my office hours, who earns close to the same income as the example above, asked me, “What do I do? My husband doesn’t want to give up the Tesla, which has a $1,200 payment!”

As you can see above in the Kashflow Calculator, the Tesla payment is nearly the same amount that should be invested – if you follow the Millionaire Formula.

I reminded them, “You have to decide what’s most important to you – a car, or financial freedom.”

Which would YOU choose?

After calculating their 20-80-20 in this module, students will upload the Wise Money Chart of accounts into Quickbooks (organized by the 5 categories).

Ultimately, they’ll learn how to run a monthly P&L to ensure they’re on track to become millionaires.

And so can YOU!

Click the button below to get started!