I’m going to keep this short and sweet.

I wasn’t planning on addressing the recent cryptocrash but I’ve received so many messages about it that I thought I’d go ahead and share my perspective.

Money isn’t real.

But it is.

Well, it is or isn’t it?

Yesterday, in my Sovereignty Academy business course, a student vulnerably addressed how he was feeling regarding the recent crash of the crypto market. He was feeling scared, anxious, and doubtful after watching his portfolio value crumble in a matter of hours.

Now, a few days ago, he was really pleased with what he saw in his Crypto Wallets.

Can you blame him?!?

Here’s the dealio …

Those that win at the investing game are playing a different game. I call it The Long Game. That means the day to day, week to week or month to month fluctuations aren’t (in most cases) important.

The distinction for a not-investor who puts money in the market (crypto in this case) banking on it only going up is called a gambler.

Investor. Gambler. Very different approaches to playing the money game.

Not-investors are reactive. They don’t have an investment narrative or strategy. They are heavily influenced by the media, the behavior of others (herd mentality) and panic when they see the numbers go down. Panic is not an emotion that precedes good buying or selling decisions!

With that said, that isn’t even the main point I’m trying to make. The point is:

- When you are emotional and make emotional decisions that means you are ‘attached’ to your money and are ‘afraid’ of losing it. You are attached to the gains. And, feel despair with the losses. That’s how most amateur gamblers feel. Think Vegas. You feel good with that stack of chips at the blackjack table. Then, feel sick when you lose it. If you do that day in and day out, that’s a path to insanity!

- Yet. Attached or Detached, the truth is all that money (high or low) is an illusion anyway! What do I mean by that?

Those numbers that present themselves when you open your account are just numbers. You think it’s money, but it’s not. It’s just numbers that you think is money. Those numbers just sit there. They go up. They go down. But, other than that, they don’t do anything.

They can’t pay your mortgage. They can’t buy your Costa Rican vacation. They can’t buy your new Tesla. They are practically just a figment of your imagination.

The only real money is the principle that you “spent” by converting your hard earned dollars out of your savings account into the purchase of the asset. The purchase (action) made it real. Because it took real money to buy the new “opportunity” of more (or less) money.

If you “sell” your services (called earnings/income) for $50,000 and then “spent” that $50,000 to buy Bitcoin, that was real money that left one account and into another (The money had to be there to make the transaction).

Over the course of a few months during a “bull run” that $50,000 goes to $100,000 on paper. Are you really worth $100,000? No! That’s just a number that makes you feel good. Or bad, if it dropped to $25,000. But, again it’s not real!

Money only becomes “real” when we “transact” with it. In other words, the $100,000 isn’t real unless we sell our Bitcoin for $100,000 as a transaction. It’s real the moment it’s used/moved/spent etc.

I reminded my student of the strategy he was playing — The Long Game and what that means. To stay calm, stay out of the media unless the information actually serves you, and to remember — the gains [and losses aren’t real until you sell.

If you’re following a buy and hold strategy, versus trading, then this stands truest.

What’s also extremely important is having a strong network of experts in your circle whom you trust and can strategize with.

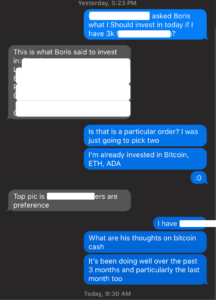

This was my daughter Macy and my convo on Wednesday (she’s in blue): [side bar: how cool is it that I talk to both of my children (ages 24 and 26)about Crypto as they are both invested!]

She invested on Wednesday and reported good results already.

Now, this isn’t investment advice or even advice to invest in Crypto. Don’t invest what you can’t lose {Investing mantra}. But for those that do remember:

- Money isn’t real [until you make it real]

- Investing is a RISKY game — you have to be willing to play by those rules

- Determine your strategy and stick with it

- Rely on your network not the media

- Do your research and trust your gut

If you’re looking for that network and simply need experts to lean on — especially in times like these — let’s chat.

Remember, you’re only one conversation away from completely shifting your financial trajectory.